Advertiser Disclosure

Prince of Travel may receive commission for some of the products displayed on this site. Advertisers are not responsible for any product reviews or editorial content that may appear on PrinceofTravel.com. For up-to-date information on any advertiser product, please refer to the advertiser’s website directly. This site is for information and entertainment purposes only. The owner of this site is not an investment advisor, financial planner, nor a legal or tax professional. The articles and content on this site are of a general informational nature only and should not be relied upon for individual circumstances. The content and opinions expressed on this site are provided by the authors of this site and are theirs alone. Said content and opinions are not provided by any third party mentioned on this site and have not been reviewed, approved, or otherwise endorsed by any such third parties.

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards, back to {post.category_name}, back to guides, the best ways to use cibc aventura points.

Let’s go over the best ways to book travel using CIBC Aventura points, which can be a useful secondary points currency for Canadians to collect.

Written by Ricky Zhang

Written by {post._embedded?.author[0].name || post.data.author}

On December 12, 2019

Read time 13 mins

CIBC’s in-house points currency is known as CIBC Aventura points, and many consumers who bank with CIBC end up collecting sizeable balances of Aventura points via the personal and business CIBC Aventura credit cards.

The reality, unfortunately, is that CIBC Aventura points do not hold nearly as much value as some of the other points programs available to Canadians, like Aeroplan , Amex MR , or RBC Avion . No matter what your travel goals are, you’d almost always be better off earning one of those points currencies instead of Aventura, if given the choice, because of their additional flexibility and value.

Having said that, the CIBC Aventura credit cards do put on some very strong signup bonuses on a regular basis, which make them a good choice as secondary credit cards after you’ve already applied for the most valuable cards out there.

In this post, we’ll cover the various ways that you can use your CIBC Aventura points to meet your travel goals, even though the overall upside to the program can be relatively limited in the end.

In This Post

Redeem aventura points for travel via cibc, cibc aventura airline rewards chart, seasonal flight promotions, transferring to aeroplan miles (for pre-2013 cardholders), …merchandise.

The baseline use-case for CIBC Aventura points would be to redeem them at a value of 1 cent per point (cpp) against travel that’s booked through the CIBC Rewards Travel Centre. For example, the current signup bonus of 35,000 Aventura points on the CIBC Aventura Visa Infinite would be redeemed against $350 worth of travel booked via CIBC.

It’s important to note that Aventura points redemptions can only be made directly through CIBC’s in-house travel agency (either online or over the phone). Unlike similar products and programs like the Amex Cobalt or the Scotia Passport , you cannot make travel purchases directly on your CIBC Aventura credit card and then choose to offset the purchase using Aventura points later on, and I’d consider that to be a major limitation of the Aventura program.

The CIBC Rewards website allows you to search for “simple” flights, hotels, and car rentals and book directly using your Aventura points.

Unless you’re booking a flight that falls under the Airline Rewards Chart (which we’ll describe below), the payment page will automatically apply your points towards the value of the booking at 1cpp.

You may also book travel via the CIBC Rewards Travel Centre over the phone, where you’ll be connected with a dedicated travel agent who will assist you with the booking.

The CIBC travel agency seems to be able to book most major flights, hotels, car rentals, and other travel products that you can find on the major online travel agencies like Expedia; however, I have found in the past that there are a few gaps in what CIBC is able to book (and therefore what you’re able to redeem Aventura points for).

For example, the CIBC travel agency cannot book flights on low-cost airlines in Europe or Asia, nor are they able to book “less mainstream” airlines such as the AirBaltic or Air Astana – flag carriers of Latvia and Kazakhstan, respectively. My attempts redeeming Aventura points for cash fares on both of these airlines resulted in the agent attempting to issue me a ticket within their backend systems, but to no avail.

(I’ve heard a few data points of CIBC travel agents allowing the customer to book whatever they want on Expedia.ca on their own and then applying the Aventura points manually, but these were few and far between, and I haven’t personally had any success doing this.)

Overall, the 1cpp redemption option should be treated as a baseline; you should never redeem your Aventura points for anything less than 1cpp. However, I must admit that it’s quite rare that I find myself needing to redeem Aventura points in this fashion.

After all, most of my flights are booked using award tickets, and the cash flights that I do buy are usually on the less mainstream airlines of the world, which Aventura agents are unable to book. And on the hotel side, I’m always booking hotels either directly with the program or through a third-party booking service in order to maximize my elite benefits.

Most often, I find myself redeeming my Aventura points for short-haul flights on Air Canada or WestJet, such as Toronto–Montreal or Montreal–New York, when the price isn’t high enough to justify redeeming Aeroplan miles . These flights also happen to be easily searched on the CIBC Rewards website, saving me a time-consuming phone call with a travel agent.

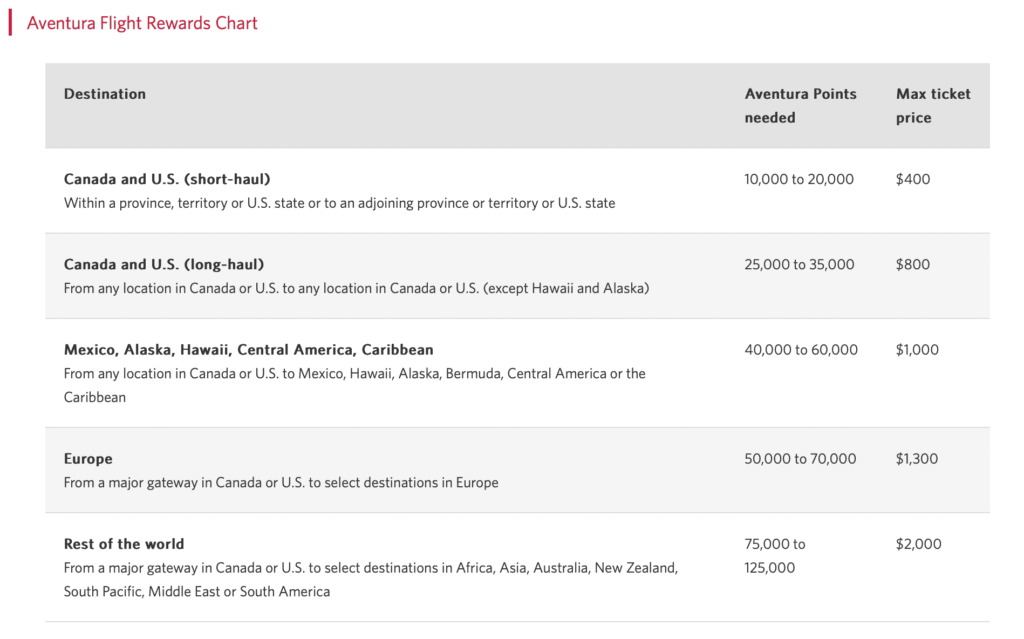

Another way to redeem Aventura points for flights is via the Aventura Airline Rewards Chart, which allows you to exchange a certain quantity of points for a cash ticket in economy class from Canada to a certain geographic region, up to a certain maximum ticket price. It’s a similar arrangement as the Fixed Points Travel program with Amex MR , or the Travel Redemption Schedule with RBC Avion .

The chart is found on the CIBC Rewards website , and can be summarized as follows:

As you can see, if you were booking a round-trip flight designated as Canada and U.S. (Short Haul), then you’d pay between 10,000 and 20,000 Aventura points for a ticket whose base fare (i.e., the price before taxes and fees) is up to a maximum of $400. If the base fare were higher than $400, then you’d also pay the difference at the standard 1cpp valuation of Aventura points.

It’s my understanding that the exact price within the range of prices (10,000 to 20,000 points, in this case) is determined by your base fare – if you’re “using up” the full maximum amount of $400, then you can expect to pay 20,000 Aventura points; meanwhile, if your base fare is only, say, $200, then you might only be charged 10,000 Aventura points for this redemption.

Note that Aventura points can be only be used to cover the base fare portion of a flight under this chart, not any of the associated taxes and fees. You may still redeem your Aventura points against the taxes and fees, but only at the base-level rate of 1cpp.

If you do the math, you’ll see that you can achieve much higher value than the standard 1cpp redemption by using the Aventura Airline Rewards Chart. Indeed, the maximum value arises when you redeem 35,000 Aventura points for a flight designated as Canada and U.S. (Long Haul) with a maximum ticket price of $800 – using up that full amount would give you a value of 2.29cpp, which is pretty amazing value for the Aventura program.

The value on maximizing the Canada and U.S. (Short Haul) region is pretty outstanding as well at 2cpp, whereas Europe, Mexico/Alaska/Hawaii/Central America/Caribbean, and Rest of the World clock in at maximum values of 1.85cpp, 1.67cpp, and 1.6cpp respectively.

(Note that the definitions of short-haul and long-haul are based on whether the respective provinces or states of the origin and destination cities share an adjoining border, and this results in a few oddities, like Toronto–Chicago being classified as long-haul even though it’s a shorter distance than Toronto–Minneapolis, which is classified as short-haul.)

If your travel patterns regularly involve paying for economy class flights within Canada and the US, then the CIBC Aventura Airline Rewards Chart could be a very suitable fit for your needs while allowing you to extract higher than normal value out of your Aventura points.

In addition to the above flight redemption options, you can also watch out for CIBC’s seasonal redemption offers, which usually partner with a specific airline like Porter, WestJet, or Air Transat to offer discounted redemptions on certain routes during a certain travel period.

For example, we’ve seen promotions where you could redeem as few as 8,000 or 9,000 Aventura points for a round-trip flight on popular routes like Toronto–New York, Montreal–Boston, Toronto–Ottawa, or Vancouver–Calgary. Overall, these promotions have largely been more favourable for Canadians living in the Eastern provinces (especially since Porter, for example, only operates on this side of the continent).

While these promotions do offer up some very low redemption price points, it’s still important to compare against the cash fare to figure out the value you’re getting, since they could still tread the fine line against the base-level 1cpp redemption in many cases.

Remember that you still have to pay about $100–150 in taxes and fees on these low-priced redemptions, so even a points rate of 8,000 Aventura points might not present stellar value when the cash tickets on the Toronto–New York route are often as low as $220 round-trip.

Always do the math against the cash price to figure out the value you’re getting for your Aventura points, and if it’s below 1cpp, then it’s best to offset the cost directly at par instead.

Finally, one important question that arises from all of the above types of Aventura flight bookings is whether you’ll earn miles when crediting these flights to a frequent flyer program. It’s my understanding that you do indeed earn miles when you offset the cost of a flight at 1cpp, since the flight is counted as a regular revenue fare that’s simply being offset using your Aventura points.

However, when you redeem via the Aventura Airline Rewards Chart or through one of the seasonal airline-specific promotions, you do not earn miles since the flight is marked as a mileage redemption – even if the flight is booked into the same fare class in all three cases.

If you’ve been an Aventura cardholder since at least 2013, then you enjoy the grandfathered ability to transfer your Aventura points into Aeroplan miles at a 1:1 ratio.

Aventura points were once freely transferrable to Aeroplan when CIBC held the main Aeroplan credit card contract in Canada; however, that ability was phased out when TD won over the contract in 2014, so only the legacy cardholders of CIBC Aventura products can still make use of this opportunity.

If you’re one of these cardholders, then transferring your Aventura points to Aeroplan will likely be the best-value usage of your points in general, especially if you’re looking to maximize your miles by booking business class or First Class flights.

If you’re content with economy class, then you can compare the price points between Aventura and Aeroplan (as well as the availability situation, since the former can book any available seat on any flight, whereas the latter is constrained by award space), and only transfer your points over if it makes sense.

Finally, we all know that redeeming points for merchandise is usually seen as a major faux-pas due to the poor value it provides; however, I’m not ashamed to say that CIBC Aventura points are the only currency that I’ve ever redeemed in exchange for a retail good.

Indeed, when the Aventura program was offering a Cyber Monday special on merchandise redemptions last year, there was a wide range of products, from iPhones to coffee makers, that were available at 50% off their usual points price, offering a value of around 1.8cpp.

Since I had no immediate plans to redeem my balance of around 35,000 Aventura points at the time (and in fact wanted to cancel the card soon), and I was in the market for a medium-sized luggage anyway, I decided to trade in 21,950 Aventura points at that 1.8cpp level for a new Heys suitcase .

21,950 Aventura points well spent!

I’d only recommend redeeming for merchandise in these situations when all three criteria are met: there’s a special offer on these types of redemptions, you’re certain you would be purchasing the product anyway, and you don’t see yourself getting higher value (such as the 1.6cpp+ redemptions through the Airline Reward Chart).

While I don’t think the Cyber Monday special offer returned in 2019, I recall there was a similar limited-time offer on Boxing Day last year as well, so hopefully that will be back this year in case you have some spare Aventura points lying around that you’re happy to exchange for some new “stuff”.

While Aventura doesn’t really have a place among the most valuable points programs in Canada, they’re still very easy to collect via the CIBC Aventura credit cards, and are good for reducing the cost of your flights and hotels here and there to supplement the more valuable redemptions you make with other currencies.

You can get the highest value (up to 2.29cpp) via the Aventura Airline Rewards Chart, while their frequent redemption promotions also represent good value. The baseline scenario – and indeed the option that I resort to the most often – would be using Aventura points at 1cpp against the cost of travel, although the fact that you must book through CIBC’s travel agency can be a major limitation.

Share this post

Copied to clipboard!

How to use CIBC Aventura points to reduce travel costs

by Anne Betts | Oct 31, 2024 | Travel Hacking , Destinations | 0 comments

Updated October 31, 2024

What are the various ways to use CIBC Aventura points to reduce travel costs ? Is the Aventura program worth it? How does it work? What’s an Aventura point worth?

Here is my review as it relates to funding travel.

Table of Contents

What is the CIBC Aventura program?

How are aventura points earned, can aventura points be converted to another program, how can aventura points be used, what’s an aventura point worth, 1. flexible travel reward, 2. flight rewards, 3. cibc by expedia, (i) book and pay with your aventura-earning credit card, (ii) log into cibc online banking and your credit card account , (iii) redeem with points while the transaction is pending, what’s to like about the cibc aventura program, shortcomings of the cibc aventura program.

CIBC Rewards is the in-house propriety program of the Canadian Imperial Bank of Commerce (CIBC). The reward currency is commonly referred to as Aventura points.

Effective October 1, 2024, CIBC’s in-house travel portal switched to CIBC by Expedia.

Aventura points are earned through credit card **sign-up bonuses and everyday spending. Depending on the credit card, bonus points can be earned on promotions, bookings at the CIBC by Expedia, and spending in accelerated earning categories such as groceries, gas, and dining. CIBC has ten Aventura-branded credit cards:

- CIBC Aventura Visa Card

- CIBC Aventura Gold Visa Card

- CIBC Aventura Visa Infinite Card

- CIBC Aventura Visa Infinite Privilege Card

- CIBC Aventura Visa Card for Students

- CIBC U.S. Dollar Aventura Gold Visa Card

- CIBC Aventura Visa Card for Business

- CIBC Aventura Visa Card for Business Plus

- *CIBC Aventura World Elite MasterCard

- *CIBC Aventura World MasterCard

*CIBC MasterCards are no longer available to new applicants.

** When applying for a CIBC Aventura credit card, look for special offers of sign-up bonuses that exceed those listed at the CIBC site. These include Milesopedia, Red Flag Deals , Great Canadian Rebates, Credit Card Genius , and Rewards Canada .

Aventura points don’t expire if an Aventura-earning credit card account is in good standing. The primary cardholder can pool points by moving them from one Aventura-earning credit card account to another.

Contrary to what you might read on the internet or be told by a seller at an airport kiosk, Aventura points cannot be converted to Aeroplan (except in special circumstances). They were before CIBC co-branded Aeroplan cards were transferred to TD in 2014, when the ability to convert Aventura points to Aeroplan was discontinued. However, grandparenting protection remains in place for cardholders of three select cards held since before October 1, 2013:

- CIBC Aventura World Elite MasterCard

Aventura points earned since then can be converted, if they have been moved to the card held before 2014. Conversion is at the rate of 1:1 and points can only be converted in increments of 10,000.

Aventura points can be redeemed for travel, gift cards, donations, merchandise, experiences, credit card statement credits, or contributions to various CIBC financial products.

As with most reward programs, travel purchases usually return the best value. On most travel redemptions, Aventura points are capable of a value anywhere between 1 and 2.2 CPP (cents per point). Most travel redeemed through CIBC by Expedia returns a value of 1 CPP. When booking ‘Flight Rewards’ using CIBC’s Aventura Flight Rewards Chart, some redemptions offer a return of up to 2.2 CPP in value.

Credit Card Genius has calculated the value of Aventura points when redeemed for purposes other than travel. For example, charitable donations are valued at 1 CPP, CIBC financial products and statement credits at 0.83 CPP, gift cards at 0.71 CPP, and merchandise at an average of 0.71 CPP.

Occasional promotions on gift cards can return a redemption value of 1 CPP.

There are four ways to redeem Aventura points for travel.

‘Flexible Travel’ is an option using the Aventura Flight Rewards Chart. It provides CIBC Aventura cardholders with the ability to pay for flights with any combination of:

- Aventura points;

- Aventura points and your CIBC Aventura Credit Card; or

- Just your CIBC Aventura Credit Card.

Unless there’s a promotion in effect, this option returns a value of one cent per point, considered the baseline value for most proprietary reward programs’ travel purchases.

Redeeming a Flexible Travel Reward involves using the Aventura Flight Rewards Chart and selecting the ‘Flexible travel’ button.

Redeeming ‘Flight Rewards’ involves using the Aventura Flight Rewards Chart and selecting the ‘Flight Rewards’ button.

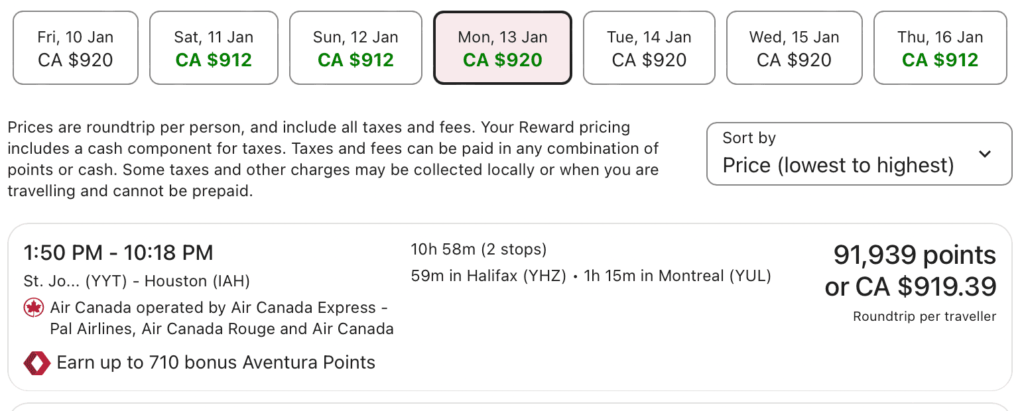

It’s for round-trip flights in various cabin classes, from basic economy to first class. Each group of regionally based destinations displays a sliding scale of points required for flights with a maximum base ticket price. The base ticket price is exclusive of taxes and other charges.

A value greater than one cent per point is possible with these redemptions the closer the cost of a flight is to the maximum ticket price listed on the chart. For example, the Canada and US (Long-Haul) travel region category shows a maximum ticket price of $800. Paying 35,000 points for a ticket with a base fare of $800 returns a value of 2.2 cents per point.

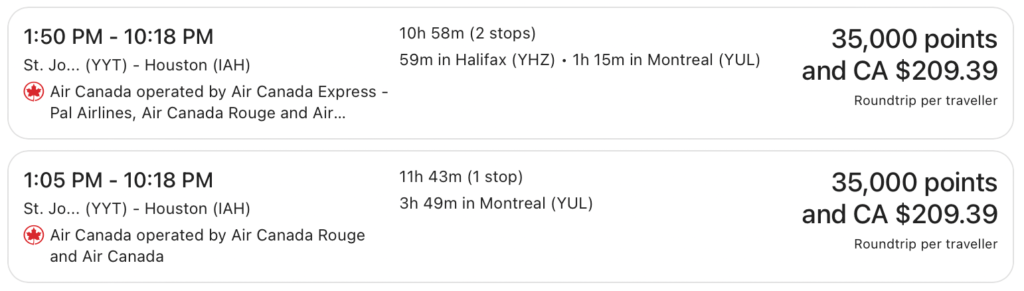

For the same St. John’s to Houston example mentioned above, a return flight in economy costs 35,000 Aventura points plus $209.39 in taxes and fees using the Flight Rewards option. Taxes and fees can be paid in any combination of points (at a value of one cent per point) and cash (charged to a credit card). After deducting the taxes and fees, the remaining $710 ($919 minus $209.39) returns a value of 2.0 cents per point ($710 divided by 35,000).

By choosing the Flight Rewards option and paying in points, the total cost is 55,939 Aventura points (35,000 on the base fare and 20,939 in taxes and fees). Instead of costing 91,939 points using the Flexible travel option, choosing the Flight Rewards option results in a saving of 36,000 Aventura points.

As an Online Travel Agency, CIBC by Expedia offers access to flights, accommodation, tours, packages, and rental cars.

It’s been a month since CIBC moved to CIBC by Expedia and I’m yet to use the service to book or redeem travel. From what I can see, it operates in much the same way as Expedia for TD.

What remains to be seen is if CIBC will introduce an accelerated earning rate for CIBC by Expedia bookings using an Aventura-earning credit card. Otherwise, CIBC faces tough competition from the TD First Class Travel Visa Infinite Card with its 4% return on Expedia for TD bookings.

4. Shopping with Points

‘Shopping with Points’ involves booking through vendors other than CIBC by Expedia. Until a 2022 promotion, the rate of 8,000 points on each $50 purchase worked out to an abysmal value of 0.625 cents per point. The promotion doubled the value of 8,000 points to $100, or 1.25 cents per point. After several extensions, the promotional redemption rate ended in October 2024 with a reduction to one cent per point to mirror the redemption rate at CIBC by Expedia.

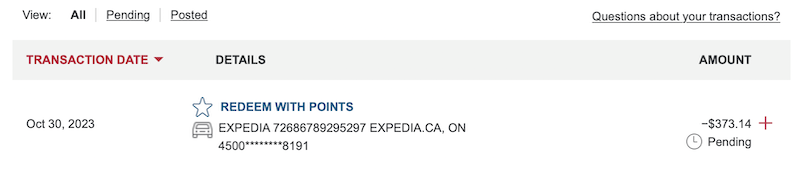

Redeeming points for travel purchases using the Shopping with Points option involves the following steps:

Make a travel purchase such as a flight, vacation package, cruise, hotel stay, or car rental at a vendor of your choice using a credit card earning Aventura points. The charge must be in Canadian dollars. I made the mistake of making a direct booking at Palmers Lodge , a London hostel, that never appeared on my account as eligible for redemption. When I booked Edinburgh and York accommodation at Expedia dot ca (before October 1, 2024), both appeared almost immediately as redeemable with points.

Log into CIBC Online Banking (or mobile banking) and search for the transaction under ‘Pending’ in your transaction history. Chances are the charge will appear as soon as the booking has been confirmed. However, it could take a few days to post, so keep checking back.

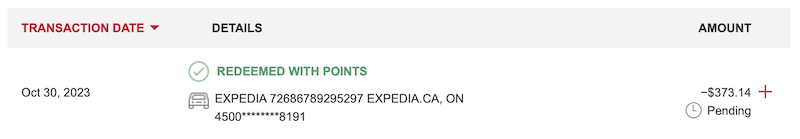

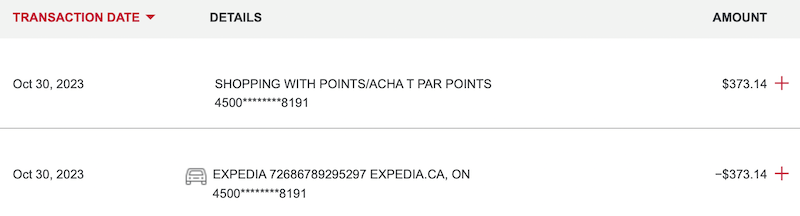

Click on ‘Redeem with Points’ (the link to redeem with points needs to be active on the transaction). If the redemption is successful, confirmation will immediately appear within the credit card account.

The credit will be posted to the respective credit card account within two business days.

This redemption option is only available while the purchase is still pending. The Shopping with Points Terms and Conditions state that it’s non-refundable, non-exchangeable, and non-transferable. Therefore, making a refundable booking with the vendor is always preferable. Many miles-and-points enthusiasts turn Aventura points into cash with refundable bookings. Others use them to reduce travel costs.

- Depending on the credit card, CIBC offers travel perks such as lounge access through the Visa Airport Companion Program membership and passes, NEXUS fee rebates, and an attractive Mobile Device Insurance benefit.

For more information on the NEXUS program, see Is a NEXUS card worth it? and How to apply for a NEXUS card .

- There are regular first-year-free promotions where the annual fee is waived for the first year. Many come with improved sign-up bonuses. In addition, it pays to check rebate and affiliate sites such as Great Canadian Rebates for elevated sign-up bonuses when applying through their portal.

- It’s possible to hold more than one credit card of the same type (e.g., more than one Aventura Visa Infinite) at the same time. CIBC can be quite generous with approvals.

- CIBC is more likely than other banks to waive the annual fee on request. It may also be possible to obtain a prorated annual fee refund when cancelling or product switching a credit card.

- There’s a no-fee card in the Aventura family (CIBC Aventura Visa Card). Applying for, or product switching to the no-fee card, can help preserve a relationship with CIBC. It can also serve a useful purpose by protecting existing Aventura points in an account between applications for other cards. However, partial redemptions (part points, part cash) offer the means to use all Aventura points with no orphan points remaining in an account.

- Aventura points can be transferred from one account to another in the Aventura family. This applies to accounts held by the same cardholder. The process is efficient and instantaneous. For holders of the CIBC Visa Infinite Privilege card, it can be done online. For cardholders of other cards, contact the CIBC Rewards Centre to execute the transfer. Unlike TD Rewards, where a minimum of 10,000 points can be transferred, any number of points can be moved from one account to another.

- Moving to CIBC by Expedia is a positive step. Online bookings at the CIBC Travel Rewards Centre were limited, and I found hotel prices to be seriously inflated.

- I appreciate the option to book travel with any vendor and immediately redeem points against the purchase.

- The Aventura Flight Rewards Chart applies to return flights. One-way flights can only be redeemed as a ‘Flexible Travel Reward’ at a value of one cent per point.

- Other than redeeming points while a charge is pending, there’s no post-purchase option to redeem points against existing reservations or previous travel purchases.

- Several Aventura-earning credit cards had accelerated earning rates for booking travel through the CIBC Travel Rewards Centre. These don’t seem to have migrated to bookings at CIBC by Expedia. The CIBC site listing their various credit cards still refer to accelerated rates at the CIBC Travel Rewards Centre that no longer exists. As previously mentioned, the Aventura program faces tough completion from the TD Rewards program and the TD First Class Travel Visa Infinite Card with its 4% return on Expedia for TD bookings. With its $100 travel credit on certain bookings and its 4% return, the TD First Class Travel Visa Infinite Card remains my credit card of choice at Expedia.

For more information on the TD Rewards program, see How to use TD Rewards points to reduce travel costs.

The inability to convert Aventura points to other programs makes them less valuable than reward currencies such as AMEX Membership Rewards and RBC Avion Rewards, which can be converted to reward programs where it’s possible to extract much greater value.

However, Aventura points can be a beneficial reward currency in a diversified miles-and-points portfolio. When viewed as a secondary program along with, for example, TD Rewards and Scene+, they can reduce travel costs by funding miscellaneous travel expenses. These include train and ferry tickets, boutique hotel stays, flights with regional airlines, tours, and various travel experiences.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use TD Rewards points to reduce travel costs

- When a no-FOREX-fee credit card isn’t the best travel choice

- 9 Effective says of meeting Minimum Spend Requirements

- Polaris review of United Airlines’ lounge and in-flight experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

Care to pin for later?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

CIBC Aventura: How to use Aventura Points for Cheap Travel

Caroline Tremblay

Use your Aventura Points for Travel Expenses

Charge the expense to the cibc aventura card.

First, simply make any travel expense of your choice and charge it to a CIBC Aventura Credit Card like the CIBC Aventura ® Visa Infinite* Card . These expenses can come from a variety of sources:

- Car rentals

- Travel agency

- Railway company

- Charter bus

- Commuter Transportation Company

- Regional passenger transportation

- Limousine, cab and others

- Regional Marine Transportation Service

Pending Transactions

Immediately after your transaction or reservation, log in to CIBC Online Banking .

The pending transaction will be in your account. Click on Use My Points .

Please note that the transaction must be made in Canadian dollars (CAD) to be eligible.

Also, it is mandatory that the transaction is pending to proceed with the refund with Aventura Points.

Redeeming Aventura Points

Normally, redeeming 16,000 Aventura Points with Shopping with Points reduces the credit card balance by $100.

But thanks to the 35% promotion on Shopping with Points , you only need 10,400 points for $100!

Automatically, the system shows the credit obtained and the points that will be deducted. Click on Use My Points to confirm.

This example illustrates the promotion when it was at 50%:

Confirmation

The confirmation is then displayed on the screen.

Then, the credit will be in your account within 2 to 3 business days. There’s now more in your pocket!

Use your Aventura Points for a Hotel Room

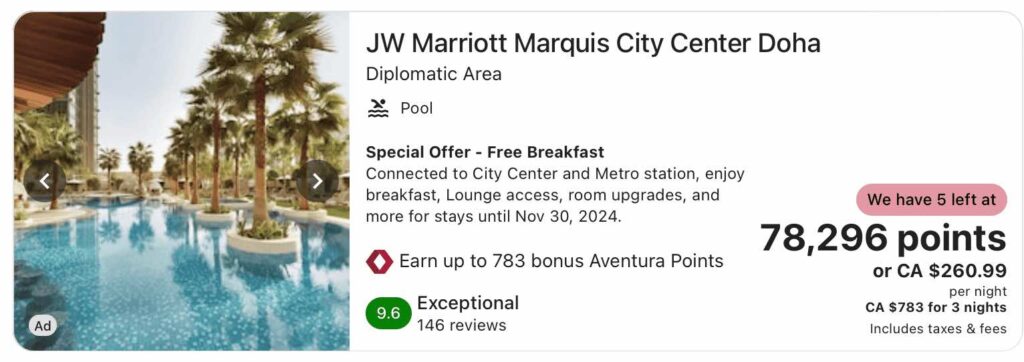

Directly on the CIBC site offered by Expedia , you can use your points to book a hotel room.

Simply search for the destination you want. During the booking process, the more points you use, the less you pay.

Use your Aventura Points for an Airline Ticket

Flight rewards.

The number of Aventura Points required to purchase an airline ticket depends on the destination. See the Aventura flight awards table on our CIBC Aventura page .

In the example above, Fort Lauderdale is considered a long-haul flight. According to the flight award chart, it requires between 25,000 and 35,000 Aventura points .

Flex Travel

There is also the opportunity to take Aventura points and use them as you wish. The exchange is one point equal to one cent .

Just like booking a hotel, the more Aventura Points you use, the less you pay for your flight.

Use your Aventura Points for an All-Inclusive Vacation Package

Thanks to the CIBC offered by Expedia in collaboration with Expedia , which acts as a travel agency, you’ll find plenty of options for vacation exile in the south.

Again, Aventura Points are redeemed at a rate of 1 point to 1 cent. The more points you use, the less you will pay for your getaway out of your own pocket.

Use your Aventura Points for a Car Rental

CIBC offered by Expedia deals with over a hundred car rental companies and offers a varied choice.

Aventura Points are redeemed at a rate of one Aventura Point equals 1 cent.

Using Aventura points for travel activities

In the Activities section, Expedia’s CIBC offers the opportunity to take advantage of theme park tickets (Universal Studios , Disney Water Park, Legoland, etc.), local attractions or to book sightseeing activities in a particular city.

Use your Aventura points for a cruise

You can also redeem your Aventura points for a great cruise vacation. Simply call 1-800-858-0407 to book and pay with your Aventura credit card.

Then, when the transaction is pending, you use the Shopping with Points option, as mentioned at the beginning of this article, to redeem your points for a Statement credit.

Bottom Line

Depending on your lifestyle, Aventura Points are good allies for paying for travel expenses. It is quite easy to use and the search tool is intuitive. If you’re familiar with Expedia , you won’t feel out of place!

In addition, the latter offers us the possibility to look at a calendar of dates where it costs less, if you are flexible in your dates. Take advantage of our offers on the CIBC Aventura Visa Infinite* Card and ® Gold Visa* Card" href="https://milesopedia.com/en/go/cibc-aventura-gold-visa-card/" rel="noindex">CIBC Aventura Gold Visa* Card to earn points for your next vacation!

View this publication on Instagram A post shared by Milesopedia (@milesopedia)

Suggested Reading

Receive our newsletter every week.

- Don’t miss any of our best current offers

- Get the latest news and tips on how to save every day

- Get more points to book your flights, hotel nights, Airbnb rentals at a discount or for free

- Travel more often with your family or travel better in business class!

Savings are here:

IMAGES

VIDEO