Tourist foreign dollar exchange rate

Currently hot topic among travelers to Argentina is the foreign tourist dollar exchange rate. Tourist credit card payments will be processed at almost the dollar Blue rate. Actually, it will be the dollar MEP rate which is close to the dollar blue rate. But what about the tourist card payment at the dollar blue rate? Read this article before you make any card payments in Argentina! Check out the video below.

Read also: the best hotels in Buenos Aires

UPDATE – December 12, 2023: The minister of Economy announced a devaluation of 54% against the USD. From 1 USD you get 365 to 1 USD getting 780 ARS.

What is the foreign tourist dollar?

In Argentina, there are many exchange rates. Those exchange rates do not follow the official exchange rate that you can find on XE.com or the National Bank of Argentina.

One of the exchange rates is the “ Foreign tourist dollar “. When making a credit card payment in Argentina you have a much more favorable exchange rate compared with the official. This means that payment at the official rate is not 10 USD but 5 USD for example.

The official rate is 1 USD = 841 ARS, Foreign tourist dollar is 1 USD = 930 ARS. For the same dollar, you will have more pesos to pay with.

There is no foreign dollar exchange rate for the EURO. It will follow the USD rate.

See the video below for the latest update:

How does it work the tourist dollar in Argentina?

First of all, it is the responsibility of the card issuer to process the payment at the tourist foreign dollar rate. In most cases, it is Mastercard or Visa. Currently, VISA and Mastercard are processing refunds after a period . But you can get charged first at the official rate. Therefore, make a small payment to test the system and wait 6-8 days. Because it may happen that you don’t receive a refund and you end up paying the double. So my advice is never to pay directly a large amount without testing especially when they charge out at the MEP rate!

CREDITCARD OR DEBITCARD

I did all the tests. I used my Mastercard and VISA credit cards. They charged me both first at the official rate. After 7 days I received a refund.

My debit cards didn’t work. I used a top-up VISA debit card and Mastercard. It’s good that I did the test with a small amount otherwise I paid double.

Be careful and make your calculations!

Argentine companies charge you in Argentine pesos at the much higher Dollar Blue / MEP rate . So, first, you pay the double and later you get a refund if it works for your credit card. Many companies are honest about it and mention it clearly in the store or on their website. In the end, you make no profit.

But the situation has changed in Argentina on December 13.

The official rate at this moment is 1 USD = 841 ARS. The tourist exchange rate is 1 USD = 930 ARS. The MEP rate is 1 USD = 1005 ARS.

Two important things:

- If the company charges you at the official rate, you are good. You will make 10 % profit. You will have the benefit of a slightly better rate when you pay with your credit card. Example: cost of a ticket at the official rate converted to USD is 10 USD (=8410 ARS). You paid with a credit card, you have paid 9,04 USD.

- If the company charges you at the MEP rate, you will lose money because of the new regulations. The company wants to receive 10 USD worth in ARS at the MEP rate to buy USD. So, they will charge you 10050 ARS. If you paid then with your credit card, you have paid 10,80 USD.

Read also: where to stay in Buenos Aires? Neighborhood tips.

Important tip to make a profit from the exchange rate

Since April 2024, the benefit of paying with your credit card is less. Because the gap between the official exchange rate and the tourist exchange rate is smaller.

The risk is now if you are going to pay a higher price! Number one tip from today: if the store of activity shows the price in USD? Then you will pay probably at the MEP rate which will be more expensive if you pay with your credit card. Unless the payment is done directly in USD. However, that will be unusual as the payment terminals in Argentina only accept ARS.

How to get the benefit of the tourist dollar?

I suggest testing your credit card first. Buy something small and wait until you get a refund or not. It can take up to 5-10 business days. This is how you avoid the surprise by paying double the amount in USD if they don’t process the refunds.

Afterward, you can use the credit card everywhere. The best is at restaurants and local stores. They will charge you at the official exchange rate and get the benefit. On top of that, almost no risk of paying double because it’s the official exchange rate.

For tourist activities, they will probably charge you at the tourist foreign dollar exchange rate and here you don’t have the benefit anymore.

Conclusion: Yes, you can make a profit when they don’t charge you at the MEP rate. This is mostly the case in restaurants and shops, … For tourist activities and hotels, make your calculation. Often it is a bit cheaper to pay directly in USD.

My roots in Buenos Aires started as a tourist. After some great adventures in Argentina, I moved in 2017 to the metropolitan city of Buenos Aires. I felt a need for correct and honest information for tourists. That's why I love to write to you. Sharing my discoveries in Buenos Aires. I hope you enjoy the city as much as I do! Buenos Aires ❤️

Related Posts

How many days to spend in Buenos Aires

Currency in Argentina: Exchange rate, Tourist Dollar, Dollar Blue, …

What to do if you get sick in Buenos Aires

Calle Florida: everything you need to know

86 comments.

Hi, Glenn, you “saved us’ in B.A. two years ago. Do you think I would get the “Tourist Rate” on my Visa card from Aerolineas Argentinas for flights soley withing Argentina? Thanks.

Hi Joseph, thanks for contacting me again 🙂 If you pay in ARS you should normally get the Tourist Rate. But you can see that at the checkout of the payment page.

Hi Glenn I’ve just returned from BA and can share my experience of using my UK issued Mastercard Credit Card. Every transaction was processed immediately at around £1=ARS 1230 (ie The Tourist Dollar Rate adjusted to GBP), so no need to wait for refunds as you described above.

Reading your articles ahead of arriving in BA were very helpful: keep up the good work !

Would you get the blue dollar rate if your booked a domestic or international flight from an Argentina airport? Thanks

I believe not. But depends on the calculation and price that the airline uses.

Thanks Glenn. I will be in BA in October and was there in May last year. I was wondering if I purchased a ticket with AA to Bogota using my visa card for payment if the blue dollar rate would apply? Thanks again.

I am currently in Argentina where I bought a few things with my credit card to check the exchange rate used. So far I h have been payed 930 per dollar. Is there a web site where the tourist exchange rate is listed on a day to day basis? Thank you very much!

Hello Glenn,

I just checked the rate of the Blue Dollar January 29/24. Yesterday was U$1 = ARS 1,195 Today is U$1= ARS 6,487!!!! Is this true?? This is insane Thank you

Never mind Glenn, It came to normal now. About 1,200.

Hi – we are travelling from the UK to Argentina and just thinking of using our credit card (pounds) as our main way to pay for things. I noticed this statement in the article above: “There is no foreign dollar exchange rate for the EURO. It will follow the USD rate.” could you expand on this please? Does that mean that we will be charged at the official rate for using a pounds credit card rather than at the MEP rate for a dollar credit card? Or will we be charged at the dollar mep rate and then our credit card company will convert from dollars to pounds? Its a little confusing! All help appreciated and we have just downloaded your app! Thanks

Hi, thank you for downloading my app :-). About the exchange rate with a credit card, I would suggest buying something small and see later on your bank statement which rate they used. It changes many times and maybe it is already different again. Testing is in my opinion the safest way.

Hi Glenn: under the section subtitled “Two Important Things,” are you saying that the credit card company is using the Tourist Rate of 917 ARS while the tourism company is using the MEP Rate of 1010 ARS? If this is the case, by using a foreign credit card, everything would cost 110.14% of the listed MEP Rate price ((1010÷917) x 100), or 10.14% more. If this is what is happening, this is terrible! It seems that the situation in Argentina is changing rapidly – I think you are going to be kept very busy keeping up with things! Keep up the great work Glenn!

I have the same question.

I do not understand this part

“ the company charges you at the MEP rate, you will lose money because of the new regulations. The company wants to receive 10 USD worth in ARS at the MEP rate to buy USD. So, they will charge you 10100 ARS. If you paid then with your credit card, you have paid 11,01 USD.”

Shouldn’t the MEP rate be better all the time with a credit card?

Hi Stephane, a company in Argentina exchanges their ARS to USD via MEP. Which is a stock exchange rate. However, that rate changes quickly too based on demand.

Secondly, the tourist exchange rate does not follow the MEP rate. It is mostly lower than the MEP rate.

In practice this means that companies will tell you “this service costs 100 USD”. They convert the USD x MEP rate = ARS you will pay. However, your tourist exchange rate can be lower. Meaning that the 100 USD will costs at the end 105 USD maybe.

Don’t all these tourist places understand that they are killing their business by charging large amounts in dollars without a good reduction based on the blue dollar? Hotel prices have become insane without the significant difference between the official rate and the blue dollar rate! I have planned a trip to Argentina in November but will cancel my whole itinerary if the real USD prices don’t become more affordable. Who will pay real USD 1100 for the Melia in Puerto Iguacu?

Hi Hubert, it are strange times here with the US Dollar. Prices are increasing in USD, and people lower consumer spending. Some businesses are dropping their prices again. I believe we have to wait some time in hope that the situation cools down and prices too.

She are due to arrive in early Feb 2024 for 5 weeks visiting ARG / CHILE. What a pain all the currency conversion is!!!! Thank you for providing this information to us tourists / visitors.

Question: We have pre-booked all accommodation via Booking.com – Example of one accommodation with a ” You will pay X Hotel is USD (1,232 USD) according the exchange rate on the day of payment. The amount displayed in AUD (1,829 AUD) is i=just an estimate based on TODAY”S exchange rate for USD” – Which will be the “exchange rate”? Official, Foreign Tourist,Dollar Blue or MEP? We are confused.

Should we cancel our Bookings?

Hi, normally if you pay with your international credit card the system will use the tourist exchange rate. They will ask to pay in ARS. It depends on the hotel which rate they will use. Normally the official but I am not sure.

I’ve used my debit visa card in the first 3 days here but I see a exchange rate at 930 pesos / 1 dollar instead of the $1,033 on the newspapers. Is this going be refunded after few days to match the current rate?

Normally you will receive a refund. But the rate in the newspaper can be blue rate. Which is not the one the card uses.

A question about all this and the above. Very interesting. We are in Argentina now and have to pay for a language course. The prices are in US dollar but the school offered us to pay in Pesos. The school uses the blue market Dollar rate (which is 1 to 1000 today!) if we get cash at Western Union, we don’t get this 1 on 1 rate but less ,I think I saw the MEP rate to be at 930? So we actually have to withdrawal more money to get to the same amount the school is asking from us. They do want to give us a discount around 15-20% if we pay cash… But if I read this I think it might not be worth it going back and forth to a Western Union, waiting in line, with the risk they don’t have that amount of cash in the house etc. etc. Could you help us out?

Hi Pien, this indeed now a common practice and a result that you. Sometimes you pay more with card. Going to WU is a good option but I am not aware when there are long waiting lines. But a better option indeed.

Hi Glenn, thanks for your information. I’m still a little bit confused and I hope you can guide me. My trip is this next 12/20. I have already booked a place but I don’t know what to do in terms of if it’s better that bring 100 USD bills or just use my Visa credit card. I’ll be spending 20 days there. Thank you.

Hi Jacobo, it is always good to have USD cash with you. The difference – at this moment – between the Dollar Blue and Tourist exchange (credit card) is almost 0%. Paying with the credit card or USD cash is the same … for now. Everything changes quickly here.

I appreciate your reply.

Hi Glenn. Am I correct that I can tip people in US dollars while traveling to Buenos Aires? Small bills are acceptable to folks? I will only be there for 3 days before a cruise and hate to exchange money if I don’t need to. Thanks!

Hi Sue, sure that will be just fine.

Is there any chance of the Tourist dollar receiving the same devaluation or will everything from now on only affect the official ARS? Because if Milei introduces another devaluation for ARS only, we would end up with having a worse exchange rate with the tourist dollar, right? Wouldn’t that kill all of argentinas tourism?

Hi Lars, there will be a monthly gradual devaluation of 2% from now. At this moment, there is only a devaluation on the official exchange rate. The tourist exchange rate will probably stay where it is now, for now. All things can change day-by-day.

If in the past I paid $20 USD for cleaning service in BA, would I now pay double ($40USD) with the recent devaluation? Or still $20 USD? I’m sorry, this is all so confusing to me.

It depends if the cleaning service increased the price in ARS and if you paid the price linked to the National Bank rate yes or no. If the cleaning service linked their prices to the dollar. Then indeed the price will increase. If they keep in ARS and increase gradually, then the price increase should be small. But I expect that all prices will match the new exchange rate of 800 ARS. If you than pay from USD to ARS, the price will go to 40 USD probably.

Great blog, some really useful tips! Still worried about being ripped off, because some of the quoted prices are steep 😱, so I’m relying on getting that ~40% ‘discount’!!!

For example, if I’m quoted hotel price in US$, but they say I can also pay in peso cash at the official exchange rate +21%vat , I’m not making any saving, or am I? Do you still get charged vat if you pay in peso cash?

Do I want to avoid paying in US cash for hotels? If I pay by peso cash, am I still getting a good rate paying at official exchange rate?

They also mentioned if I pay by card, I get charged 40% more because charged in dollars. Do you usually have a choice to pay in peso by card, is that usually possible? Will I still get MEP rate if I pay by card in US$ or is it just for peso?

Hi Linda, to get the 21% VAT exemption you need to pay the hotel with an international credit card. Normally the hotel should charge you in the official currency ARS. But of course they can apply the blue rate to it which will end up the same in USD.

However, you can pay in ARS cash but than indeed the 21% VAT will apply. And they can still charge you at the blue rate.

As mentioned in the article, it becomes more and more difficult to get a major discount.

Today – December 12th, 2023 – the new government will announce new economical measurements. Which can have an effect on tourists.

I keep everybody here up to date about the tourist exchange dollar.

Would love a full update on the new changes in December impact tourist in early 2024 travel dates!

How will blue dollar and tourist dollar follow this devaluation?

The difference is small now. Official is 800, blue 960 and tourist 945. For now, the benefit negligible.

The way I see it, everyone in argentine got 54% wage cut. The problem here now, as devaluation of pesos will continue by 2% every month, that it is good for exports, but bad for imports. So business wins here. Second thing here is that the common people will search for dollars even more, when you know that your purchasing power is lower every month. I suppose, give it some time, a month, and the blue dollar market will rise again.

Do most cafes and restaurants give a discount for paying in cash?

Regards, Aidan

Linda, In response to your hotel question, I’ve been staying at Marriott and IHG hotels for the past month. Before the official rate doubled yesterday from 400.50 to 820 pesos, it was 100% cheaper to pay pesos. He’s how the hotels calculate the peso price. Let’s say on the Marriott app that a hotel room is $100. You multiply that dollar amount (100) by the official rate (820) which equals to 82,000 pesos, roughly $82 dollars. All hotels doubled in price today. The official rate was 400.50 yesterday so do the same math $100 × 400.50 = 40,050 pesos roughly $40 dollars. I had hotels booked this whole month I’m canceling all of them and getting an airbnb. All the math mentioned above for hotel prices will change whether you pay in cash (pesos) or foreign credit card. Cash will add a 21% tax/fee. With credit card, you will not pay the 21% tax. So your hotel bill above is 82000 pesos total. You divide 82000 by the visa rate which is 945 today and you get $86.77 per night total no taxes and fees. It used to be half that yesterday.

Thanks for your blog! Very helpful. I have the first experiences. I paid 20k ARS and my bank (UBS) charged me 19.15CHF so ~22USD means ~910ARG . The official rate for blue dollar was this day ~970, I managed to change for 950. So I got 7% less than Blue, and 4% less than I was able to negotiate. Western union offered 920 that day. So I would say first option cash, second Credit card, third official exchange office. I also tried Revolut and pay in USD, don’t do it! I was charged official rate ~400. Cheers!

The difference between the blue Dollar rate if you physically exchange money and MEP via your credit card seems to sit around 15%. How does this work out when paying for a hotel stay? I understood that when using a foreign card for hotel stays they don’t charge VAT. If so, this would off-set the 15% margin which I mentioned above and could potentially make it even more appealing to use a card or am I missing something. Thanks.

Hi Maarten, to get the VAT discount you need to pay with an international credit card. It all depends which rate the hotel uses. The official or blue. If they use the official… then you are lucky. If they use the Blue rate you will end up at the same amount in USD but no VAT.

Maarten, You gotta do the math which one is cheaper. As I mentioned in another comment, I’ve been staying at Marriotts and IHG hotels in BA for the past month. There was an few days 2 weeks ago where the credit card rate was around 767, so say your hotel bill is 50,000 pesos. Add 21% for cash and it’s 60,500 pesos total (roughly $60) Or, you could use card and get charged 50,000 pesos on your card, you divide that by the visa rate of 767= $65.19. So in this scenario, paying cash WITH the added 21% would be cheaper by $5 per night. Trust me, it’s a hassle here keeping up with the exchange rates as they change daily and you’ll be doing a lot of grade school math 😆 This is the rate Visa uses. It’s 100% accurate as I’ve tested it out many times.

https://dolar-turista.fiservargentina.com/

Visa and Mastercard charges show up instantly for me. I use Chase bank. But I’ve notice Visa is accurate with the above website but Mastercard is not. The day I tested it the rate was 895 and Visa was spot on, but Mastercard was at a 820 after my calculations. If you have Visa, you Visa.

“Afterward, you can use the credit card everywhere. The best is at restaurants and local stores. They will charge you at the official exchange rate and get the most profit. On top of that, almost no risk of paying double because it’s the official exchange rate.”

I’m not sure I understand the above, in particular “charge you at the official exchange rate”. When I travel overseas, I get charged in the local currency. Then my bank converts it to dollars at their rate. So presumably I’m paying in pesos, an exchange rate is n/a at that point. What am I missing?

Hi Morgan, restaurants and local stores are having “normal Argentine Peso” prices as also locals are going there. So, they will ask for 36.500 ARS for a dinner. Which is officially 100 USD but you pay with your credit card 50 USD for example. At tourist activities such as tango shows, bike tours, boat tours, etc… they will ask 73.000 ARS. Because they know that you have a benefit with your credit card. At the end you will pay 100 USD but first you will get charged 200 USD with afterward a refund. The rate of that refund you don’t know. It’s based on the exchange rate of that day.

Hello! I have an upcoming trip to Bs.As. and Patagonia and am in the process of researching accommodation. What is the best site / app to book hotels in Argentina these days? Airbnb is dollarized, must be paid up front, and won’t refund VAT. Booking.com and Agoda offer direct pay to properties, but they, too, seem dollarized (at least for Patagonia). In fact, when I asked about exchange rate, no one seems to want to deal with the official rate, essentially bringing the peso price to the same level as the dollar price.

Hi Susan, what you say is correct. Almost everything for tourist these days will get charged at the “unofficial” rate = same as US dollar. They need to accept Argentine pesos cash or by card, but indeed at the higher rate. That’s how it goes here these days.

Thanks for the reply, Glenn!!

Thanks for all the useful infos I have a Mastercard (HSBC) and a Visa (Scotiabank) from Canada.

Any idea if there was a website online I could try a small charge in ARS (like a dollar) to make a test and see how much both cards charge me before making more purchases?

Thanks a lot

Just came back from BA and was solely using VISA card; exchange rate was about 372.45ARS for USD (454.39ARS for GBP). Be aware that this is an exchange rate used by VISA and your bank may charge other fees on top – that’s where the difference may be; worth noting that cashpoints would charge you 24ARS service fee but I’m not sure what the withdrawal limit is. Also take into account that places with good exchange rates had loooong queues in front of them; And, some places, like Recoleta Cemetery, was only accepting cards.

Was in Ushuaia and BA mid to end April 2023- Charged as much as i could on JPMC Visa, conversion was instant to about 20-30 Pesos lower than Blue Rate and no transaction fees. Amex charged full amount first, then issued a credit about a week later to bring it back to the 20-30 Pesos discount on Blue Rate. (Note: depending on the card, the provider may charge another transaction fee).

I was in BA last month and received multiple refunds on my Amex, but there’s one transaction for 450 dollars that I never received a refund – now I’m scratching my head trying to figure out what to do.

Also take into account that places with good exchange rates had loooong queues in front of them; And, some places, like Recoleta Cemetery, was only accepting cards.

I have been in Argentina for a month, and using your card, there is no way to get a tourist rate. You need to come with cash, go to Uruguay, or use some sort of money program to send money to yourself and you get close to blue rate but they will take at least 30 pesos off the blue rate. That rate is still better than the official. So I just send myself cash, and that’s how I do it.

As of yesterday, this doesn’t work anymore. Visa is back to the official rate. Be careful! Don’t use your card if you don’t want to pay double!

Hi just wanted to share my experience, my bf and I have been using our Charles Schwab Visa card and have been getting a rate the Blue rate! We aren’t sure if it works for buying things online 🤔

Hi Maria. Were you using the Schwab VISA debit card? I was told by Schwab to choose the Argentine peso option and not the US dollar option when signing off on the transactions in order to get the MEP rate. Is this information correct? Thank you for sharing.

That’s correct. Always pay in ARS. However, make first a small payment and check if the MEP rate gets processed on your credit card.

How can I test my credit card to see if MEP rate gets processed before arriving in BA? What small payment can I make in the US to test this? Is it better to use a Master Card or an American Express card in BA?

Hi Jane, unfortunately you cannot check the MEP rate with a credit card payment outside. However, you can buy a small thing on MercadoLibre but you need to have a delivery address.

hey Glenn, glad I found your blog and appreciate all the helpful information. checked a few other blogs as well about blue rate payment and still wondering whether it’s working and even more whether it’s also working with an EU/EURO Credit card. Maybe you (or someone else) has an update on that?

Hi Benedikt, normally it should work. But sometimes not. Debit cards for example no. Amex also not. Touristic activities are mostly in USD.

Appears the Credit Card will use a blue (or close to) rate is not happening. Can others please keep updating their experiences as to if they get a close to blue rate or a refund? Thanks.

Anyone know if you can while in Buenos Aires send money to yourself via Western Union using your ATM or credit card

This is fake news. Bought a ticket for Teatro Flores in AR$ online using Mercado Pago, got charged the (ripoff) official rate. I would still advise to use cash for everything while in Argentina!

Just tried it in the Jumbo supermarket with my Maestro Card. I was charged the common official rate, curious if I’ll get a refund later.

paid with mastercard on 13 Dec and the tourist rate still not applying!! Western Union is an option but for some countries (like South Africa where I live- I’m from here) you do need to be there to transfer as the app doesnt work.. and of course the idea is to avoid carrying so much cash ufffffff

Thank for sharing your experience. Some are reporting getting a refund on MC payments. Have you since received a refund? Thanks.

Hi there Maria, could you perhaps elaborate a bit more on what you mean when you said, South Africans need to be there for the app to work. I’m still here in SA and want to transfer funds to myself and collect it in BA via WU. Do you mean the app does not work while we are in SA?

Hi Maria, I’m also from South Africa and curious if there’s any update…

Dec 7 and onwards: Several of us made credit card payments at hotels and restaurants, all charged at official rate. One of us got refunds on certain (but not all) transactions to the tune of 45% of the transaction amount. Neither the merchant not the credit card company recognize the refund so we’re wondering if Mastercard corrected the ARS to USD rate on those transactions…

Western Union is giving 330 pesos to the dollar on any WU transactions sent to Argentina. Have sent money recently and will again to myself before i travel down there. One of the WU places that will give you money is Pago Facil at 825 Montevideo Buenos Aires. I called them to see if they could handle a 500 dollar exchange and they said no problem.. Only issue is walking around BS As with a wad of 1000 peso notes in your pocket or bag.

They are lying. They run out of money constantly. They have massive lines (1-2 hours) and you don’t know if they are out of money until you get to the front of the line. Also, they may hand it all to you in 100s. I’m here right now and experiencing it.

Update Dec 11 2022: still not working with Visa Credit Card. Paid the entrance to Recoleta cemetery with card (only option) and it used the official exchange rate.

You should talk about the option of using Western Union to transfer money to yourself. Western Union uses the blue dollar rate. It is very practical , easy to do and avoids you carrying piles of us dollar cash. There are Western Union offices everywhere in Argentina. Thanks

Hi Gilles, in the article “where to exchange money in Buenos Aires” I explain that option 😊

I’m in Argentina and it’s still not working, 3 weeks after it was announced. Given that the banks in Argentina are essentially owned by the government, I doubt it will ever be put in effect given there general lack of competence in nearly everything.

Unfortunately, it is still not working. So I‘ll keep on exchanging at the „cuevas“. It is shameful that the government announces the new exchange to be effective as of November 4th and it is still not working. I am sure that the problem lies with the Argentine government.

do you have any suggestions for paying for car rental in Argentina? They all seem to want paying by credit card which would probably mean the terrible official exchange rate. thanks Graham

Hi Graham, search on Google for a local car rental and ask to pay cash. In smaller cities they do it often.

I am in Argentina now November 18 and have been testing this for a couple weeks….it is not working on my USA Credit Cards (Visa or MC)

Shane, thank you for this update. and Glenn for your post. I will be travelling to Buenos Aires. My brother-in-law mentioend this new rate for foreigners using their credit cards, but clearly this seems easier said than done.

Hi- Love your site. Usually get hotels near Ave Florida so I can find a blue dollar Cambio. But this time for a special reason I have a hotel near Ave San Juan and Ave Passeo Coln – San Telmo. Do you know of any trustworthy “cueva” around that area. Or I guess I am in for a long walk Kind regards David T – Tasmania

Hi David, there is exchange office in San Telmo. A “cueva” is more around Av. Florida.

Just go to any western union. My niece got a rate of 304 for one USD

I used my Master Card few times this week (Nov. 7 to 11 ) and the exchange rate i got was 162. I have stopped using the card and I am only using cash that I received thru Western Union.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

- Airport Transfer

- Book Tango Show

- Follow Instagram

- Top Attractions

- See a Tango Show

- Best Day Trips

- Food and Drinks

- Hidden Secrets

- Itineraries and Walks

- Football Match tickets

- Travel Checklist

- Airports and airlines

- Exchange money

- Best Time to Visit

- Get a Sim Card

- Best Hotels

- Where to Stay

- Public transport and taxi

- History and Facts

- Cycling in Buenos Aires

- Christmas and New Year

- Patagonia travel tips

Tourist Dollar Rate

Us dollar / argentina peso : tourist dollar rate historical chart, dolar turista : periodical high, low & average.

This is the Tourist Dollar Rate of US dollar in Buenos Aires, Argentina.

This is known as the Foreign Tourist Dollar , it means payments made on foreign credit cards use the “ MEP ” (“Electronic Payment Market”) dollar exchange rate. In other words, if you’re paying by card, your dollars go further than before.

Currently, the “foreign tourist dollar” only works for purchases, and not cashpoint withdrawals.

Mastercard joined the program on December 2 and Visa followed suit just under two weeks later, meaning payments made in Argentina through foreign credit card from those companies are now processed at the MEP dollar rate.

Also known as : Tourist Dollar , Foreign Tourist Dollar , Dólar Turista

What Argentina's New Tourist-Friendly Preferential Exchange Rate Means For You

Stunning geography, a captivating culture, and flavorful local cuisine are just a few of the many reasons travelers set their sights on Argentina. From the colorful rock formations of Salta and the Buenos Aires Tango Festival to the awe-inspiring views at Iguazú Falls, Argentina is packed with places to explore. As Latin America's second-largest country, Argentina welcomes more than 7 million international visitors annually to enjoy all it has to offer.

While it's an appealing place to visit, financing the experience here isn't always simple. Since the 1980s, Argentina has struggled significantly with inflation. At the end of 2022, economists feared inflation could reach 100%.

The country's practice of printing money for public spending through the central bank is frequently named as a driver of inflation. Currency depreciation is another detrimental factor. A culture of informal foreign currency traders in Argentina means there are more than 10 varying exchange rates at any given time. This setup can make it difficult for visitors to determine what the peso is worth. This is especially problematic when attempting to use debit or credit cards.

A new regulation known as "the foreign tourist dollar" was put in place in Argentina on November 4, 2022, in an attempt to ease the burden. It's designed exclusively to address tourist-friendly currency exchange rates. While it doesn't necessarily simplify the complex system in place, it could make using credit and debit cards a streamlined process for foreign visitors to achieve more favorable exchange rates during their travels.

How the new rate works for foreign tourists

In Argentina, the official exchange rate has long been acknowledged as the least effective route to making a traveler's money go further. Instead, the country hosts a widespread black market commonly referred to as the "blue market." Within this system, travelers either exchange currency at a lower than the official rate under the table or pay for services directly in US dollars to achieve savings.

The new tourist-friendly preferential exchange rate that is now in place was crafted partially in hopes of minimizing this cash-heavy culture. The option for foreign visitors to use debit and credit cards more freely in exchange for better rates has the potential to boost the government through a documented, electronic trail of sales tax. Additionally, government officials hope tourists carrying less cash into the country will reduce opportunities for crimes like theft .

Before the tourist-friendly preferential exchange rate, foreign credit and debit cards used across Argentina were universally subjected to the official exchange rate. This new preferential rate adjusts the standard so that foreign credit and debit card payments used for purchases apply to the Electronic Payment Market ( MEP ) instead. As of January 2023, that meant foreign travelers could make their US dollars go 78% further by paying with a credit or debit card.

Potential benefits for travelers and residents

Both Mastercard and Visa joined the new preferential exchange rate program in December 2022. The inclusion of these credit card companies has made purchasing options in Argentina accessible to a wide range of foreign travelers. While the benefits across cards are equivalent, there are some differences to note.

Visa cardholders see their payments processed at the MEP dollar rate immediately when purchasing products in Argentina. Those making purchases through Mastercard will initially receive the official exchange rate. Reimbursement for the difference between the official exchange rate and the MEP will be applied a few days later.

One benefit of this exchange rate for foreign travelers is the opportunity to visit at a lower overall cost. Not worrying about extreme rate fluctuations could make travel to Argentina less stressful. Similarly, not worrying about where to go on the "blue market" for profitable transactions could boost tourism and safety simultaneously.

The new rate could also benefit some Argentine residents. Presently, those who hold foreign credit cards can take advantage of the new rate by making their local purchases on a Visa or Mastercard. A "tourist dollar" exchange could be advantageous for locals as inflation continues to rise.

While the program is new, travelers will likely continue to carry cash out of habit. With time, this new rate boosts the potential for significant cultural change as well as savings for visitors to the country. The combination could see Argentina enjoying enhanced traveler numbers in the near future.

Argentina Adds Another Exchange Rate—for Tourists Only

The argentinian government implemented a new regulation on november 4, 2022, allowing visitors using credit and debit cards to obtain a more favorable exchange rate than the official rate..

- Copy Link copied

The government hopes the new rule for credit and debit cards will discourage all-cash transactions that leave cash-laden tourists more vulnerable to robbers.

AP Photo/Natacha Pisarenko

In recent years, a moment often came when a visitor to Argentina suddenly grasped they could have gotten a lot more bang for their bucks if only they had brought cash to buy pesos on the unofficial market.

A dollar sometimes would buy twice as many pesos in informal cash trading as the amount in pesos it would get in purchases using a credit or debit card covered by the official exchange rate.

“You can almost hear the blood drain out of their voice when they realize this,” said Jed Rothenberg, owner of a travel agency that specializes in trips to Argentina.

That should, at least in theory, be a thing of the past as of Friday. The government has implemented a new regulation allowing visitors using credit and debit cards to get more pesos than the official rate gives.

On Friday, one dollar was officially worth 157 Argentine pesos. But in the unofficial market, commonly referred to as the “blue dollar,” it could be worth as much as 285 pesos. And in the system that will now be used by credit card operators, it was at 292.

The informal foreign currency traders became more ubiquitous after strict capital controls were put in place in 2019 in an effort to protect the local currency from a sharp devaluation amid the country’s high inflation.

Why the new rule?

The government hopes the new rule for credit and debit cards will discourage all-cash transactions that leave cash-laden tourists more vulnerable to robbers—and also often deprive the government of sales taxes that are frequently ignored if there is no electronic trail.

Rothenberg sought for years to explain Argentina’s different exchange rates and the difficulties that tourists faced in using credit and debit cards. He wasn’t always successful.

“The vast majority of people are just confused: ‘You mean there’s more than one exchange rate and that one of these can be as much as a double- or even triple-digit difference?’,” Rothenberg said.

The new rule won’t do much to reduce confusing complexities. It adds yet another exchange rate to the more than 10 that already exist in Argentina—a system that makes it impossible to say simply what a peso is worth.

The government also imposes different taxes on converting foreign currency depending on what it will be used for, leading to rates that have colloquial names like the “Qatar dollar” for travelers (a reference to the World Cup), the “Netflix dollar” for streaming services, and the “Coldplay dollar” to book foreign artists to play in the country.

The reason why no one can really answer how much a peso is worth is because “it’s worth something different for each person,” said Martín Kalos, an economist who is a director at Epyca Consultores, a local consultancy.

“The government has been segmenting the market. There is no one value, there are multiple prices depending on who you are or what operation you want to do,” he said.

The government’s goal is to have a stronger peso to pay for the country’s imports in hopes of keeping price rises from worsening. The economy registered an annual inflation rate of 83 percent in September.

President Alberto Fernández’s administration “is implementing palliative measures, or patches, because it has elections a year from now” and any efforts to correct these distortions would likely cause economic pain that would be costly at the ballot box, Kalos said.

Argentina has gone through so many financial crises in recent decades that its citizens are distrustful of their currency, so those who earn enough to save usually do so in dollars or euros.

Even economically savvy Argentines are often confused.

Anyone who has not received subsidies from the state or who operates in certain financial markets can buy as much as $200 a month but must add an additional 65 percent tax to the official exchange rate.

Argentines who pay for foreign currency purchases on their credit cards pay a surplus of 75 percent over the official rate. But that is as long as they spend less than $300. If they spend more than that a month, the surplus increases to 100 percent.

Argentines can also buy dollars through the financial markets via operations through bonds or stocks but pay a peso price similar to that in the informal market. That is the system made available to credit card processing companies Friday.

Experts said they have to see how the new system for visitors is implemented before knowing whether it will be successful.

But if implemented well, Rothenberg said the change could be a boon for tourists.

“They’re just using their credit card, they don’t care about the details,” he said. “If they actually make this work, Argentina could be one of the top tourist destinations within the next couple of years, especially with how expensive the U.S. and Europe are right now.”

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Betting Sites

- Online Casinos

- Wine Offers

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

Argentina introduces better exchange rate for tourists that will help holiday money go further

‘the measure introduces an exchange rate 90 per cent superior to the official one applying to all tourist expenses in the country’, article bookmarked.

Find your bookmarks in your Independent Premium section, under my profile

Sign up to Simon Calder’s free travel email for expert advice and money-saving discounts

Get simon calder’s travel email, thanks for signing up to the simon calder’s travel email.

Argentina’s government has introduced a new regulation for exchange rates, meaning tourists using credit and debit cards will get more pesos for their money than previously.

In the past, poor exchange rates for card users have meant it is better value to bring large amounts of foreign currency and change it informally via unofficial traders (known as the “Dolar Blue”).

Tourists using this method have historically got up to twice as many pesos per pound or dollar than they would have by using their foreign debit or credit card, for which the exchange rate is based on the official one used by banks.

However, following the change to government regulations, the exchange rate for credit or debit card users is far better - equal to the “Dolar MEP” (one of 10 or so different exchange rates in Argentina’s somewhat confusing system).

Based on a cash conversion on Friday 4 November - the day the new rate took effect - one US dollar was officially worth 158 Argentine pesos, but a tourist could get up to 285 pesos by exchanging with a “Dolar Blue” trader.

Following the change to government regulations, however, they could get a superior 292 Argentine pesos per dollar with the more favourable rate for non-Argentinian credit and debit card transactions.

The government hopes the move will encourage tourists not to bring wads of cash for exchange (leaving them vulnerable to muggings and robberies), as well as allowing official transactions to be taxed.

The change is also aimed at tempting in more international tourists, who will get far more for their money and may feel more secure making payments on card rather than exchanging cash with unofficial traders.

“Effectively the measure introduces an exchange rate 90 per cent superior to the official one applying to all tourist expenses in the country, including excursions, meals and tourist packages,” reported the Buenos Aires Times .

“According to official calculations, of the roughly US$200m-$250m entering the country monthly via tourism, only US$30m comes through the formal sector,” it added of the untracked money coming in via the “Dolar Blue” system.

Jed Rothenburg, director of Buenos-Aires-based travel specialist Landing Pad BA, told the Herald : “If they actually make this work, Argentina could be one of the top tourist destinations within the next couple of years, especially with how expensive the US and Europe are right now.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Want an ad-free experience?

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

Argentina’s Wild Economy & Current Exchange Rates

Argentina has several different currency exchange rates, which can be confusing for visitors.

If you’re wondering what the ‘Blue Dollar’ is and why it even exists, read this post and check our currency converter below to save yourself a lot of money while visiting Argentina.

Table of Contents

Argentina’s Economy: A Brief History

Argentina enjoyed an abundant beginning to the 19th century and was one of the world’s richest countries only one hundred years ago.

The French coined the phrase, ‘rich as an Argentine’ after seeing their lavish spending habits in Europe during the Belle Époque.

Argentina still has a wealth of natural resources and fertile land.

The riches of yore are most evident in the capital, Buenos Aires.

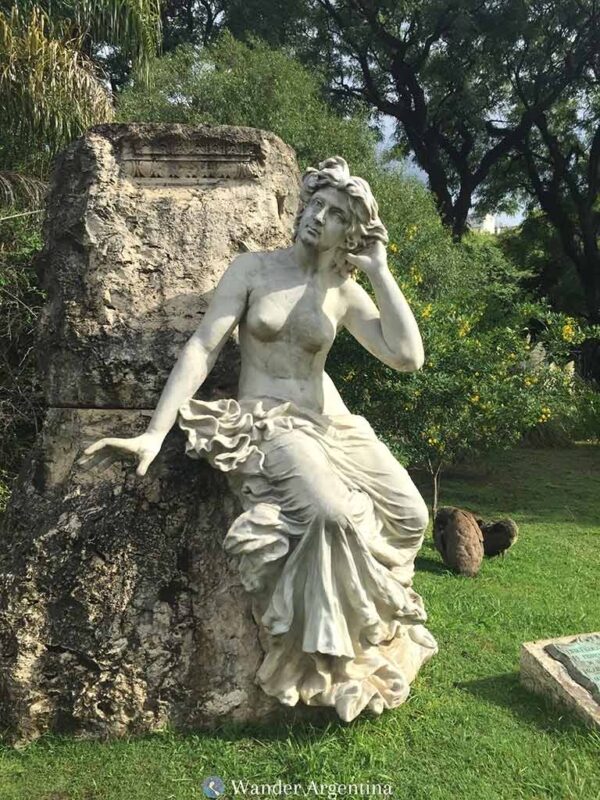

There are beautifully landscaped parks and plazas, buildings decked out in marble and brass, and elegant public statues such as the Nereids Fountain dotted all over the city.

The Argentine Paradox

The previous wealth of Argentina is most evident in some of the city’s biggest tourist attractions such as Avenida de Mayo’s Tortoni Cafe and Recoleta Cemetery , where departed Argentines forever rest in the luxury of pricey mausoleums.

Since the golden days, a chaotic political landscape, a succession of military takeovers, corruption and free-for-all privatization in the 80s and 90s wreaked havoc on the economy.

Economists refer to the stark economic decline in Argentina as the ‘Argentine Paradox.’

How did a resource-rich country that had a similar GDP to Canada one hundred years ago fall so far?

It’s no mystery for those who live in Argentina (the unorthodox economic model for one thing!) nonetheless, countless essays have been written on the topic.

The Argentine Paradox is often contrasted with the Japanese Paradox.

As far as Argentina has fallen, Japan has risen. Japan experienced such economic growth that it grew to become the third-largest economy in the world in the same time frame, despite a scarcity of natural resources.

Before the economic collapse at the turn of the millennium, Argentina was a more expensive destination than Europe.

Argentina’s devastating 2001 economic crisis and the resulting devaluation of the peso meant lost savings for citizens who kept their money in the bank.

The country’s economic situation stabilized somewhat for citizens the decade after the turn-of-the-21st century crisis.

Employment increased and poverty rates fell for several years, but Argentina is on a constant roller coaster ride and the future is always uncertain.

One positive turn for the economy was that Argentina’s tourism industry has grown since 2021, as travelers discovered they could get more mileage for their moolah.

Since that time, Argentina has gained a reputation as an extremely affordable destination to visit and even to reside, attracting digital nomads, and self-described ‘expats.’

With destinations such as elegant Buenos Aires and the Alpine town of Bariloche , some liken it to visiting Europe on a South American budget.

Now those traveling to Argentina with foreign currency will still find it affordable ( Buenos Aires’ fabulous subway still only costs $.30 tops) but the future is uncertain as always.

Recent changes are shaking things up, and budget adjustments are making it tough for locals.

Foreign visitors are noticing higher costs too.

A Little History of the ‘Blue Dollar’

Throughout Argentina’s history, the currency has seen significant fluctuations, largely influenced by political shifts and economic policies.

Under Cristina Kirchner’s presidency from 2007-2015 strict currency controls were introduced, leading to a substantial black market for dollars.

During these years, Argentina was popular with travelers who came for the six-dollar steak and Malbec dinners.

Things get confusing for those using old guidebooks because when Mauricio Macri’s became president in 2015, he stabilized the currency flow and largely diminished the use of the black market by foreigners.

Prices inched upward during the few years the currency market was normalized, until September 2019, when the government reinstated its ‘creative’ currency controls amidst dwindling foreign exchange reserves.

This paved the way for the return of the Peronist government, with Cristina Kirchner serving as Vice President this time.

Once again, this change led to a divergence between the official bank exchange rate and the black market rate, commonly referred to as the ‘ Dólar Blue ‘ (Blue Dollar) rate.

To illustrate the huge breach: in January 2021, the official rate for one U.S. dollar stood at approximately AR$86, while the parallel market offered around AR$151.

This spread escalated by January 2022, with the official rate at $104 and the parallel market soaring to $204.

Those numbers will be surprising for newcomers who learn that the ‘Blue Dollar’ is now worth over AR$1000 per dollar.

Argentina’s Different Exchange Rates Today

Visitors will still want to leverage the Blue Dollar rate to optimize currency value.

The Blue or Black market dollar is listed in local newspapers as the ‘ dólar informal ‘ (informal dollar) while the ‘ dólar oficial ‘ (official dollar) is the official bank rate.

To confuse things further, there are a bunch of other exchange rates listed in newspapers.

One such exchange rate is the ‘Soy dollar’ that gives soybean farmers a favorable rate to boost the agricultural sector.

The ‘Qatar dollar’ was tied to the rate for those who traveled to view Argentina play the 2022 World Cup.

The “Netflix dollar’ is used to describe an inflated exchange rate tied to various taxes applied to foreign streaming services.

Less colloquial is ‘ contando con liquidación ‘ or the CCL rate, an investment rate of securities in pesos sold for dollars in foreign markets.

Money transfer services use this mechanism, thus they can often offer better rates than the Blue Dollar.

Whatever you do: don’t exchange money in a bank because that is where you’ll get the lowest rate.

¡Blue Dollar Still A Thing!

With Argentina’s ‘creative’ currency controls, the situation is that travelers can save money if they come to Argentina with U.S. dollars in cash, or even by using a money transfer service , which often offers a superior rate, to send money from a bank account at home.

The black market for the ‘Blue Dollars’ remains robust, as Argentineans don’t trust their currency and prefer to save dollars.

The Blue Dollar is still also thing for visitors who want to take advantage of the rate.

Not to mention cash is needed daily.

Many family-owned businesses want to avoid foreign credit card purchases due to fees on their end.

It is common for smaller stores to offer an additional discount for cash or charge a 10-15% surcharge on foreign cards.

To exchange dollars on the black market you need crisp 100 bills (usually dollars, but Euros and Reales are dealt on the black market too).

Outside of Buenos Aires, it may be more difficult to find money transfer services, especially in small towns, so it pays to carry some USD for backup.

Travelers may find they can even get more pesos in exchange for their US dollars in more remote areas of the country because people in the provinces have a harder time finding dollars to purchase.

On the other hand, it can sometimes be difficult to find a place to quickly change money in a pinch while traveling around the country, so make sure to have various options to access your money.

Carrying USD or Euros to exchange for pesos is also a good way to avoid, not just a bad official and lower MEP exchange rate, but also steep ATM fees, which run about a minimum of US$8 per withdrawal in Argentina, for any amount.

Understandably some don’t feel comfortable carrying lots of cash, but even those who don’t bring in foreign currency will be carrying wads of cash in Argentina, as the bill denominations are small.

Those used to using credit cards or Apple Pay for every purchase will have to adjust.

A light travel jacket with hidden inside pockets is a great option to conceal your cash.

→ To read about exchanging money on the street in the Buenos Aires black market, read Black Market Money Exchange & Other Hustles on Florida Street

Live Currency Converter

Try our currency converter to compare Argentina’s official, Blue Dollar rate and Western Union rate all in one place.

Input the number of dollars you want to exchange and press return to see the real live rate:

Keep in mind that these are the rates before ATM, Western Union and ‘ arbolito ‘ (money changing) fees.

Input a US$ amount

OFFICIAL RATE

US$ 1 = AR$

WESTERN UNION

MEP Credit Card/Debit Card Rate

The MEP (‘Electronic Payment Market’ in its Spanish acronym) rate, introduced in late 2022 to boost use of traditional banking for visitors, offers a more favorable exchange rate using a debit or credit card.

It also doesn’t include American Express debit or credit cards, so leave that card at home.

As of 2024, the MEP rate closely mirrors the Blue Dollar rate or lags slightly behind.

CASH / BLUE DOLLARS • Visitors, just like most Argentines, will be unable to get their hands on any foreign currency in Argentina, unless they use the black market. They can also sell ‘Blue Dollars’ at a favorable rate.

CREDIT CARD RATES • A rate called the MEP rate was created in late 2022, allowing foreigners to receive the MEP rate for Mastercard and Visa debit and credit cards, which tends to be 3-10% less than the Blue rate.

ATMs • ATMs only remit Argentine pesos, at the MEP rate for most foreign cards (American Express is an exception) but have low withdrawal amounts and fees of around 20-30%

Read this post to figure out how to handle stacks of cash , and why you should bring ‘Big Headed Benjamins’ to exchange.

Relying on both the Blue Dollar or a money transfer service is better than ATMs. Most travelers avoid using ATMs because of their offensively high fees.

Argentina’s 2024 Currency Rollercoaster

Now that Javier Millie is president, and taking a chainsaw to Argentina’s spending, the spread between the official and blue dollar is shrinking to around 15%, although it varies.

In theory, this means Argentineans have more purchasing power, but rampant inflation disrupts that notion.

Javier Milei intends to dollarize Argentina’s economy, which involves adopting the US dollar in place of the Argentine peso. His long-term strategy aims to stabilize the economy to combat inflation and encourage investment.

Argentina tried this policy in the early 1990s, after a similar period of recession and hyperinflation when the government fixed the peso’s exchange rate at one-to-one with the US dollar.

This move initially created a rare period of prosperity and Argentines gained the ability to travel abroad more affordably.

But the fixed exchange rate artificially inflated the peso’s value, creating an economic ‘fiction’ that collapsed under the weight of reality, which caused the economic crash of 2001.

Milei’s current push for full dollarization is seen as a bold measure to normalize the economy and build confidence in Argentina, although many feel it is a risky policy, as the country’s history illustrates.

Argentina not only has incredible landscapes and exciting cities but also one of the world’s most dynamic currency markets.

Make sure to keep abreast of the situation because exchange rates fluctuate every day and policies can change at any time.

→ To read about transferring money from your home bank account if you don’t have cash, read Money Transfers to Argentina

Our Services

Privacy Policy

Airport Pickup

Attend a Soccer Game

Book Accommodation

Driving & Car Rental

©Wander Argentina 2024

All rights reserved.

As Amazon Associates, Wander Argentina earns from qualifying purchases

StarTribune

Buenos aires is incredibly cheap for tourists right now — but will it last.

Buenos Aires was in the throes of Southern Hemisphere springtime, with bold, budding purple jacaranda trees lining the boulevards. Genial locals filled up the sidewalks and plazas and flocked to countless city parks. Meanwhile, Taylor Swift was gearing up for her first concerts ever in Argentina, and the media and fans were in a frenzy.

But what I couldn't get over during an early November visit was how affordable everything was, at least for us tourists — a fact that concealed problems under the surface for Argentina.

Take our spacious corner king suite in the full-service boutique hotel Mio , with a big wooden soaking tub and wraparound floor-to-ceiling windows revealing the Euro-style streetscape. I reserved it online at $386 a night, but it later showed up on my credit card statement at $156.

Or an Argentine parilla (steakhouse) spread of juicy sirloin, salmon and frites with rice, pumpkin, a dollop of fried cheese, big bottles of beer and wine, and even more veggies for our baby. Using Argentine pesos I had wired to myself, the entire feast on the sidewalk patio at cash-only Las Cabras set me back about U.S. $38.

A fine leather handbag at Nimes, the kind of boutique you ring a bell to enter? Officially $350, but $108 for my partner.

Rides around the city via Uber, which is unauthorized but tolerated in Buenos Aires? $3 to $5 plus tips.

In short, Buenos Aires was downright cheap for us, even as Argentina was suffering under a whopping 140% inflation rate on the eve of a consequential presidential election. It may change very soon, but it was a dream scenario for any traveler accustomed to sticker shock abroad: a super strong U.S. dollar, combined with a special exchange rate just for tourists.

And to think that we owed this discovery to Taylor Swift.

The tourist dollar

When my partner, Sabrina, regretted missing Taylor's Eras Tour at home, I thought, "Well, where else is she playing? " International options included Mexico City (been there), Sao Paulo and Buenos Aires — the latter at legendary El Monumental, one of the largest soccer stadiums in the Americas. Swift was a good excuse to cross the so-called "Paris of the South" off our wish list.

Other reasons? The U.S. State Department rates Argentina a Level 1 — safer than most of Western Europe, and among the safest places in Latin America, a consideration when crossing the globe with an 11-month-old.

Sabrina's resale concert ticket on StubHub was not cheap, however, nor was our flight, because we did not buy them with pesos. (I'll explain in a bit.) The 10-hour final leg was particularly grueling with our sleeping 23-pound daughter on my lap. Bleary-eyed, the first thing I saw in baggage claim was a Visa ad promising "a special dollar rate for foreigners."

Money in Argentina is complicated, but because of a long-simmering economic crisis, there are many different exchange rates. One dollar would officially buy us about 350 pesos, but visitors have long been able to wire money or even buy pesos on the black market at much higher rates. So one year ago, the government made it legal and instituted the " tourist dollar " (also called the "MEP" dollar). Since then, if you pay for things in pesos with a foreign Visa or Mastercard, you'll get a wildly favorable exchange rate — about 860 pesos to the dollar while we were there, and more than 940 today.

It was all very confusing and required more economics reading than I usually do for a vacation. Bottom line: Our bills came to about a third of what we might have expected, leaving plenty of pesos for tips. Hopefully we helped stimulate the tourism economy, but it made us wonder if the tourist dollar was good or bad for Argentina.

Infinite city

Theoretical physics gives us the concept of the infinite universe, where everything imaginable goes on and on, well, forever. That was how I felt exploring the barrios of the ninth-largest city in the Americas, with 3 million inhabitants. Boulevards, plazas, cafes and leafy balcony-filled neighborhoods stretched to the horizons — all of it baby-friendly and easily plied by stroller. Street art blended with classic architecture, yet neighborhoods like Recoleta and Palermo maintained a posh character.

Two blocks from our hotel was the city's signature sight: Recoleta Cemetery, a labyrinth of Art Deco and Neo-Gothic crypts including the resting place of former First Lady Eva "Evita" Peron. I was particularly into how nearby modern high-rises — like a hulking green observation tower — struck a contrast above all this beautiful historic gloom.

We Ubered to the touristy Caminito, where brightly colored houses lined the pedestrian streets and wax figures of Lionel Messi and other soccer stars held aloft the FIFA World Cup trophy that Argentina bagged last year. From there, our walking tour took us to vinyl haven Eureka Records in San Telmo, where the owner was amazed at my baby's on-rhythm clapping to a Nina Simone cut.

Near the urban archaeology site El Zanjon de Granados, most adults were more interested in lining up for pictures with a statue of the beloved Mafald a , a "Peanuts"-like comic strip character. Eventually, we arrived at the gorgeously pink presidential palace Casa Rosada, where Evita once implored Argentina, from the balcony, not to cry for her — at least in Madonna's retelling . The national landmark was surrounded by security fencing.

In a nation known for governmental drama, 2023 has been no exception. While we were there, Argentina was preparing for a runoff election between what looked to an outsider like two bad choices: Minister of Economy Sergio Massa, a Peronist who arguably helped the country into its mess, and libertarian TV personality and wild-haired demagogue Javier Milei, who promised radical reforms such as switching from the peso to the dollar.

Could Milei even do that, and would it help? Most experts are skeptical. But my garrulous Uber driver Andres Esteban, the only Argentine who brought up politics with me, was all for a change. Complaining about the welfare state, he held up a bright orange 1,000-peso bill and lamented, "This is only $1!" Andres told me he was voting for Milei.

I asked if he liked the idea of Argentina undergoing "dollarization." "Why not?" he replied. "They did it in Ecuador and El Salvador. At this point, we have nothing to lose."

Sunday life

Sabrina reported that the Taylor Swift concert was an amazing communal experience among a record 68,000 fans — mostly screaming young Argentine women. I spent the evening on baby duty, wandering into the Recoleta Cultural Center, where Argentine abstract artists were on display and a hip-hop dance festival was breaking out in the halls. My daughter watched it all from her carrier, curiously.

The day after, we boarded a huge Buquebus passenger ferry for a one-hour cruise across the broad, brown Rio Plata for an overnight in Uruguay. The old town of Colonia del Sacramento was historic and charming, and we rented a quaint 18th-century house on the water. But it poured rain on our only night, and there was no Argentine tourist dollar discount.

For the second half of our trip, we checked into another hotel in the bustling Palermo Soho district. On a warm Sunday afternoon, we lived like Argentines, flocking to free attractions like the city botanical garden.

Families poured into the 44-acre Ecoparque , which reopened in 2018 as a more animal-friendly reimagining of the old city zoo. Patagonian maras, a sort of rabbit-like rodent, roamed the grounds freely, beside stealthy exhibits for giraffes and other species. My daughter had her first-ever ride on a classic carousel, with emotional support from the little girl on the horse beside her.

We crossed the wide avenue to the Rosedal, a regal garden of over 18,000 roses. A crowded "Greek Bridge" spanned the Lakes of Palermo, overlooking dozens of families gliding over the water in deluxe white paddleboats. Inflation or not, Argentines were enjoying Sunday life in a city that makes it easy to do so.

Days after we left, Argentina elected Javier Milei in a surprise landslide, and the country plunged into the economic unknown. As he takes office Dec. 11, it's unclear whether he'll try to "dollarize" the nation. If he's successful, he could beat inflation — and without pesos, there would presumably be no "tourist dollar" anymore. But his attempts at reform might also push the country further into crisis.

Whatever happens, I'm rooting for Argentina — a destination worth experiencing at any exchange rate.

Simon Peter Groebner is Travel editor for the Star Tribune.

- They paid for dental implants that were never completed. Then their Woodbury dentist closed his doors.

- Searchers struggle to remove vehicle submerged in Minnesota River in Bloomington

- Once 'credibly accused' Duluth priest wins fight to return to church, retires weeks later

- Tricked-out townhouse near Lake Riley in Chanhassen lists for $1.19 million

- Souhan: Predicting which young Minnesota sports star will shine brightest

- 5-year-old pulled from Edina apartment pool has died

That cool Tony Awards moment when Jay-Z joined Alicia Keys? Turns out it wasn't live

Tonys moments: hillary clinton and (sort of) jay-z in the house, strides for women and a late upset, the washington post's leaders are taking heat for journalism in britain that wouldn't fly in the us, if you can't stay indoors during this us heat wave, here are a few ideas, sabato de sarno unveils gucci precision saturated in color to close milan fashion week.

- Some international destinations where Taylor Swift is playing in 2024 Dec. 8, 2023

- This wild backcountry ski area, six hours from the Twin Cities, is not for beginners — that's the point Dec. 1, 2023

- 'Van life' has its ups and downs over five nights in Northern California Nov. 24, 2023

- 6 giant trolls are the stars of a free summer treasure hunt in northwestern Minnesota • Travel

- Minnesota Waterfall Awards: 12 of the best falls across the state • Travel

- This magical site near the Mississippi pays tribute to Stonehenge-style megalithic structures • Travel

- The great Chicago debate: Should you go by plane, train or automobile? • Travel

- A complete, opinionated guide to Delta Air Lines' SkyMiles changes for 2024 • Travel

© 2024 StarTribune. All rights reserved.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Argentina adds another exchange rate -- for tourists only

FILE - A man checks rates at a money exchange house in Buenos Aires, Argentina, July 14, 2022. The government implemented a new regulation on Nov. 4, 2022 allowing visitors using credit and debit cards to obtain a more favorable exchange rate through financial markets that will give them far more pesos than the official rate. (AP Photo/Natacha Pisarenko, File)

- Copy Link copied

BUENOS AIRES, Argentina (AP) — In recent years, a moment often came when a visitor to Argentina suddenly grasped they could have gotten a lot more bang for their bucks if only they had brought cash to buy pesos on the unofficial market.

A dollar sometimes would buy twice as many pesos in informal cash trading as the amount in pesos it would get in purchases using a credit or debit card covered by the official exchange rate.

“You can almost hear the blood drain out of their voice when they realize this,” said Jed Rothenberg, owner of a travel agency that specializes in trips to Argentina.

That should, at least in theory, be a thing of the past as of Friday. The government has implemented a new regulation allowing visitors using credit and debit cards to get more pesos than the official rate gives.

On Friday, one dollar was officially worth 157 Argentine pesos. But in the unofficial market, commonly referred to as the “blue dollar,” it could be worth as much as 285 pesos. And in the system that will now be used by credit card operators it was at 292.

The informal foreign currency traders became more ubiquitous after strict capital controls were put in place in 2019 in an effort to protect the local currency from a sharp devaluation amid the country’s high inflation.

The government hopes the new rule for credit and debit cards will discourage all-cash transactions that leave cash-laden tourists more vulnerable to robbers — and also often deprive the government of sales taxes that are frequently ignored if there is no electronic trail.

Rothenberg sought for years to explain Argentina’s different exchange rates and the difficulties that tourists faced in using credit and debit cards. He wasn’t always successful.

“The vast majority of people are just confused: ‘You mean there’s more than one exchange rate and that one of these can be as much as a double- or even triple-digit difference?’,” Rothenberg said.

The new rule won’t do much to reduce confusing complexities. It adds yet another exchange rate to the more than 10 that already exist in Argentina — a system that makes it impossible to say simply what a peso is worth.

The government also imposes different taxes on converting foreign currency depending on what it will be used for, leading to rates that have colloquial names like the “Qatar dollar” for travelers (a reference to the World Cup), the “Netflix dollar” for streaming services and the “Coldplay dollar” to book foreign artists to play in the country.

The reason why no one can really answer how much a peso is worth is because “it’s worth something different for each person,” said Martín Kalos, an economist who is a director at Epyca Consultores, a local consultancy.

“The government has been segmenting the market. There is no one value, there are multiple prices depending on who you are or what operation you want to do,” he said.

The government’s goal is to have a stronger peso to pay for the country’s imports in hopes of keeping prices rises from worsening. The economy registered an annual inflation rate of 83% in September.

Fernández’s administration “is implementing palliative measures, or patches, because it has elections a year from now” and any efforts to correct these distortions would likely cause economic pain that would be costly at the ballot box, Kalos said.

Argentina has gone through so many financial crises in recent decades that its citizens are distrustful of their currency, so those who earn enough to save usually do so in dollars or euros.

Even economically savvy Argentines are often confused.

Anyone who has not received subsidies from the state or who operates in certain financial markets can buy as much as $200 a month but must add an additional 65% tax to the official exchange rate.

Argentines who pay for foreign currency purchases on their credit cards pay a surplus of 75% over the official rate. But that is as long as they spend less than $300. If they spend more than that a month, the surplus increases to 100%.

Argentines can also buy dollars through the financial markets via operations through bonds or stocks but pay a peso price similar to that in the informal market. That is the system made available to credit card processing companies Friday.

Experts said they have to see how the new system for visitors is implemented before knowing whether it will be succesful.

But if implemented well, Rothenberg said the change could be a boon for tourists.

“They’re just using their credit card, they don’t care about the details,” he said. “If they actually make this work, Argentina could be one of the top tourist destinations within the next couple of years, especially with how expensive the U.S. and Europe are right now.”

Why Cash Is No Longer Convenient for Tourists In Argentina

Due to the government extending the preferential exchange rate to bank cards, such method of payment by non-residents has increased by 280%

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/bloomberglinea/EXGRFRQMRFBY5LAJQPZ6GFKNMI.jpg)

Due to a measure introduced by the Argentine government, payments with bank cards by non-residents increased by 280% (Bloomberg/Paulo Fridman)

Read this story in

Buenos Aires — Visiting Argentina at Easter can be a very enjoyable experience, and to attract tourism a very favorable exchange rate was added in recent years as a result of the persistent devaluation of the Argentine peso. But to make the most of every dollar, it is necessary to understand which is the most convenient form of payment and to know some particularities of the Argentine currency market.

At present, due to the effect of the exchange rate, there are no fewer than a dozen different rates for the US dollar in the country, which makes it difficult for foreign tourists to understand how to pay.

To prevent the dollars of foreign tourists who arrive in the country from feeding the informal market, at the end of 2022 the Argentine government implemented a preferential exchange rate mechanism through which the value of the MEP (electronic payment) dollar is recognized instead of the official exchange rate when payments are made with bank cards.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/bloomberglinea/XUS2G7QZNFFLJABZR3UU7OD3TM.jpeg)

Tourists in Córdoba, Argentina Photo: Municipalidad de Córdoba.

Card payments

Until the end of last year, paying with plastic was not a convenient method for tourists, given the level of the exchange gap, which last year was located on average around 90%, and people could receive almost twice as many pesos on the informal market than what a card would represent against the official rate.

But after the implementation of the new mechanism in mid-December, and after VISA and Mastercard adapted to the measure, the situation has been reversed, and now it is more convenient to use a card for payments than cash.

The entry of foreign currency into the official market by non-resident tourists shot up by 282% between September 2022 and January of this year.

“In January 2023, revenue was $164 million, 282% higher than the $43 million in September 2022,” the government acknowledged in a report presented by cabinet chief Agustín Rossi in Congress.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/bloomberglinea/U2FE23NXBRHFPCIDI2233PFUQU.jpg)